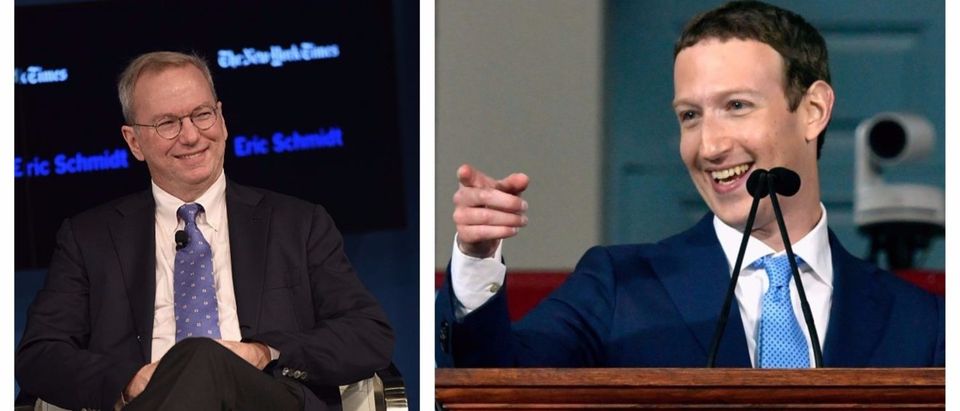

Google and Facebook continue their dominance in the U.S. digital advertising market, according to updated predictions by eMarketer.

The two tech giants are expected to grab roughly 63.1 percent of the U.S. digital ad spending in 2017 combined, an uptick from a prior estimate of 60.4 percent, reports the market research company. Facebook and Google, in total, account for roughly 90 percent of the growth in new advertising revenue. The companies dwarf all other corporations in the industry.

Google, including all of the companies under its umbrella like YouTube, will garner $35 billion in total digital ad dollars in the U.S, according to eMarketer. If ultimately true, it would be an 18.9 percent increase from last year.

Facebook, including Instagram, will collect $17.31 billion, a huge 40.4 percent surge compared to the previous year. (RELATED: The Way Facebook Measures Ads Is Likely Misleading Business Partners, Perpetuating Ad Dominance)

Their supremacy, both separate and combined, has grown so stark that they are often referred to as a “duopoly.”

And no industry has seemingly taken more offense to this growth than the media, which sees the two tech companies as eating away at their main source of revenue.

Media organizations, including giants like The New York Times and The Wall Street Journal, are banding together under the coalition known as the News Media Alliance (NMA) to earn more from the online advertisement revenue market. The group is petitioning federal lawmakers to provide them an exemption from antitrust regulations, according to multiple reports. Such a reclassification would allow media organizations to collectively negotiate with the two tech conglomerates, which is important for the industry’s attempts to earn more ad revenue and end Google and Facebook’s hegemony.

Press Gazette, a British media outlet, launched a petition in April in an attempt to stop Facebook and Google from “destroying journalism” by hogging digital ad revenue from traditional news publishers.

“By 2020 it has been estimated that 71 per cent of the money spent on digital advertising in the UK will go to Google and Facebook,” the Press Gazette’s official petition reads, showing the problem is not just endemic to America.

Google and Facebook’s digital ad dominance is why the Press Gazette’s campaign is accompanied with a “Duopoly” logo (a play off of the popular board game “Monopoly”) featuring a figure with the likeness of Facebook CEO Mark Zuckerberg.

We have launched a new Press Gazette campaign – Duopoly: Stop Google and Facebook destroying journalism https://t.co/dMAzQq0N0S pic.twitter.com/5hZLXxpa5I

— Dominic Ponsford (@Domponsford) April 10, 2017

Snapchat is expected to grow 115 percent this year to $642.5 million, but that will only amount to 1.1 percent of the U.S. mobile ad market share. EMarketer predicts Twitter’s US ad revenue will drop by 10.8 percent to $1.21 billion, meaning its stake will fall to 1.5 percent, a 0.4 percent decrease from last year. Such statistics show changes for Snapchat and Twitter, but more importantly demonstrate how they are just a drop in the bucket compared to Facebook and Google.

And both tech companies don’t just dominate the advertising market — they also have a disproportionate stake in the mobile app marketplace.

Send tips to eric@dailycallernewsfoundation.org.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.